In today's fast-paced world, unexpected financial emergencies can arise at any moment. Whether it's a medical bill, urgent car repair, or unforeseen expense, having access to immediate funds is crucial. For South Africans facing such situations, quick online payday loans with same-day deposits offer a viable solution.

What Are Short-Term Loans with Same-Day Payout in South Africa?

A payday loan is a short-term, unsecured loan designed to bridge the gap between immediate financial needs and the next payday. Typically, these loans are for small amounts and are intended to be repaid in full when the borrower receives their next salary. Due to their short-term nature and the risk to lenders, payday loans often come with higher interest rates compared to traditional loans.

How Do Payday Loans Work in South Africa?

In South Africa, payday loans are regulated under the National Credit Act (NCA), which ensures that lenders operate within set guidelines to protect consumers. The process of obtaining a payday loan generally involves the following steps:

- Application: Borrowers can apply online through the lender's website. The application typically requires personal details, employment information, and banking details.

- Assessment: The lender assesses the applicant's creditworthiness and ability to repay the loan. This may involve checking credit records and verifying income.

- Approval: If approved, the loan agreement is presented, detailing the loan amount, interest rate, fees, and repayment terms.

- Disbursement: Upon acceptance of the terms, the funds are deposited directly into the borrower's bank account, often on the same day.

- Repayment: The loan amount, along with any interest and fees, is typically repaid in a lump sum on the borrower's next payday. Some lenders may offer instalment options.

How to Get a Quick Payday Loan in South Africa

Obtaining a quick payday loan in South Africa involves several steps:

- Determine the Loan Amount Needed: Assess your financial requirement to borrow only what is necessary.

- Research Reputable Lenders: Identify registered credit providers compliant with the National Credit Regulator (NCR). Some reputable lenders include:

- Wonga: Offers flexible payday loans with a straightforward online application process and same-day payout upon approval.

- Koodo: Provides instant online payday loans up to R5,000 with quick and easy application routes.

- Sunshine Loans: Offers small payday loans from R500 to R4,000, with applications processed 24/7 and funds typically available by the end of the business day.

- Prepare Necessary Documentation: Common requirements include:

- Valid South African ID

- Proof of income (recent payslips)

- Three months' bank statements

- Proof of residence

- Complete the Application: Fill out the online application form on the chosen lender's website, providing accurate personal and financial information.

- Await Assessment: The lender will evaluate your application, which may involve a credit check and verification of provided documents.

- Receive Funds: Upon approval, the loan amount is disbursed directly into your bank account, often on the same day.

Key Considerations When Applying for a Payday Loan

- Eligibility Criteria: Applicants must be South African residents, aged 18 or over, with a regular income and an active bank account.

- Loan Amounts: Lenders offer varying loan amounts. For instance, Finance 27 provides loans ranging from R800 to R6,000, while Sunshine Loans offers amounts between R500 and R4,000.

- Interest Rates and Fees: The NCA caps the maximum monthly interest rate at 5%. However, additional fees such as initiation and service fees may apply. For example, borrowing R1,000 could result in a total repayment of approximately R1,370, including interest and fees.

- Repayment Terms: Repayment periods vary by lender but are typically aligned with the borrower's payday. It's crucial to understand the repayment schedule to avoid additional charges.

Benefits of Online Payday Loans

- Convenience: The online application process allows borrowers to apply from anywhere at any time, eliminating the need for physical visits to lending offices.

- Speed: Many lenders offer instant decisions, with funds deposited on the same day, providing quick access to needed cash.

- Accessibility: Individuals with less-than-perfect credit may still qualify for payday loans, as some lenders focus more on income and employment status.

Potential Risks and Considerations

- High Costs: Due to higher interest rates and fees, payday loans can be expensive. Borrowers should ensure they can repay the loan on time to avoid falling into a debt cycle.

- Debt Cycle: Failure to repay on time can lead to additional fees and interest, making it harder to settle the debt.

- Credit Impact: Defaulting on a payday loan can negatively affect credit scores, impacting future borrowing ability.

Best Payday Loan Providers in South Africa

Here are some reputable payday loan providers in South Africa:

- MyMulah: South Africa Offers safe and secure payday loans with same-day decisions and payouts. New customers can apply for up to R4,000.

- Finance 27: South Africa Provides same-day loans ranging from R800 to R6,000 with a simple online application process.

- Sunshine Loans: South Africa Offers small payday loans from R500 to R4,000 with a quick application process and fast approval.

- Koodo: South Africa Provides instant online payday loans up to R5,000 with a quick and easy application process.

- Lime Loans: South Africa Offers quick and secure payday loans online with instant funding.

- Capipush: South Africa Provides same-day online payday loans up to R4,000 with a hassle-free process.

Tips for Responsible Borrowing

- Assess Necessity: Only borrow if it's absolutely necessary and for essential expenses.

- Borrow What You Can Repay: Avoid taking out more than you can comfortably repay on your next payday.

- Understand Terms: Read the loan agreement carefully, ensuring you understand all terms, interest rates, and fees.

- Explore Alternatives: Consider other financing options, such as personal loans or credit cards, which may offer lower interest rates.

In conclusion, quick online payday loans with same-day deposits can provide immediate financial relief for South Africans facing urgent expenses. However, it's essential to approach these loans with caution, fully understanding the terms and ensuring that repayment is manageable to avoid potential financial pitfalls.

Frequently Asked Questions

What are quick online payday loans in South Africa?

Quick online payday loans in South Africa are short-term loans designed to provide fast financial relief. These loans are processed online, and if approved, the funds are deposited into your bank account on the same day or within 24 hours.

How do payday loans online in South Africa work?

Payday loans online in South Africa work by allowing borrowers to apply for a short-term loan through a lender’s website. The lender reviews the applicant’s financial details, and if they meet the requirements, the funds are transferred quickly. The repayment is usually due on the borrower’s next payday.

Can I get payday loans online same day in South Africa?

Yes, many lenders offer payday loans online same day in South Africa. If you apply early in the day and meet the eligibility criteria, you may receive your funds within a few hours.

What is the difference between personal loans and instant payday loans?

Personal loans often have longer repayment terms and may require more documentation, while instant payday loans are short-term and provide immediate financial assistance, usually with same-day payouts and fewer requirements.

What are the requirements for personal loans same day payout South Africa?

To qualify for personal loans same day payout South Africa, you typically need:

A valid South African ID

Proof of income (recent payslips)

Three months’ bank statements

Proof of residence

An active bank account

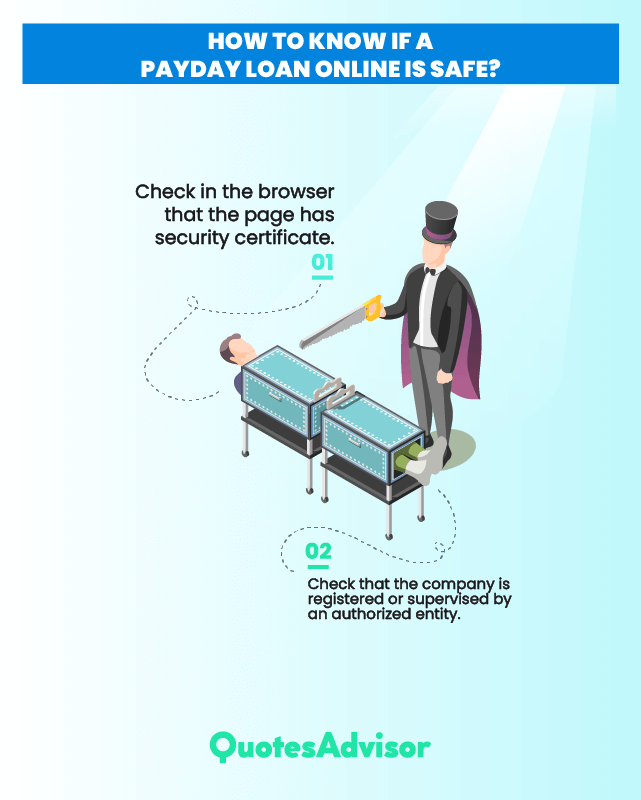

Are short-term loans online same day payout South Africa safe?

Yes, short-term loans online same day payout South Africa are safe when borrowed from licensed and registered lenders under the National Credit Regulator (NCR). Always verify the lender’s credentials before applying.

Can I get instant loans same day with bad credit?

Some lenders offer instant loans same day to individuals with bad credit, but they may charge higher interest rates. Consider checking your eligibility with different lenders to find the best option.

What happens if I cannot repay my payday loan on time?

If you fail to repay your loan on time, you may incur penalty fees, additional interest, and a negative impact on your credit score. If you anticipate difficulty in repayment, contact your lender to discuss alternative arrangements.

Questions from users

Is the calculator free?

Yes it is

Can I Phone the bank on Fridays?

Yes you can

Are the companies open during the summer?

Yes they are

I want 10000 and by using a sassa card, so can I get it?

Payday loans are granted to people who have regular jobs and income. The idea is that you borrow money and repay it the following month when your salary is accredited into your bank account. This does not work for recepients of SASSA cards. There are other options for beneficiaries of social grants such as yourself, though; please, read our articles to find out more.

I would like to ask, can I apply for an emergency loan and repay after a week all the cost?

In the case you need to apply for an emergency loan and start repaying after a week, for example, you can choose the private financial company, Wonga. With this company, you can obtain a minimum amount of 500 rand and choose a repayment period with a maximum period of six months.

I need to urgently apply for a R8,000 loan. What steps should I take?

If you are looking for a payday loan of about 8,000 rand in an urgent way, you can resort to Power Loans, for example. This South African company offers clients the possibility to obtain up to 8,000 rand with a repayment period of 90 days and with an interest rate of 2626.55 rand approximately.